Skrill — Full In-Depth Review

Introduction: Skrill’s Changing Role in the Betting Ecosystem

Skrill has long been one of the most recognizable e-wallets in online betting. For years, it was widely used across sportsbooks, poker rooms, and casinos due to its speed, accessibility, and broad acceptance. Originally launched as "Moneybookers" in 2001, it pioneered the concept of a digital wallet tailored specifically for the gambling industry.

However, the role Skrill plays in betting has changed significantly. While Skrill remains a legitimate and widely accepted payment method, it is no longer suitable for arbitrage betting or high-frequency betting strategies. Policy updates, stricter compliance procedures, and bookmaker profiling have reshaped how Skrill fits into modern betting workflows.

This comprehensive Skrill review is written with that reality in mind. We have expanded our analysis to cover every aspect of the service in 2025: from the nuances of the VIP program and mobile app performance to a brutally honest breakdown of fees and compliance risks. This is not just a summary; it is a user manual for getting the most out of Skrill.

Pros

- Speed: Instant deposits and fast withdrawals

- Acceptance: Supported by 99% of betting sites globally

- VIP Program: Reduced fees and multi-currency accounts for active users

- Security: FCA regulated with 2FA and fund segregation

- Crypto: Integrated crypto buying/selling features

Cons

- Fees: FX fees (3.99%) are high without VIP status

- Compliance: Aggressive monitoring can flag innocent accounts

- Arbitrage: Not suitable for sharp/arb betting strategies

- Bonus Restrictions: Often excluded from bookmaker welcome bonuses

- Verification: Strict KYC is mandatory

What Is Skrill?

Skrill is a digital wallet (e-wallet) operated by the Paysafe Group, a major financial services provider that also owns Neteller and Paysafecard. It allows users to store funds electronically and make payments online without sharing banking details directly with merchants.

In the betting context, Skrill acts as a middleman between your bank account and the gambling operator. This offers a layer of privacy—your bank statement only shows a transaction to "Skrill," not to "Bet365" or "PokerStars." This is a crucial feature for users in jurisdictions where gambling transactions might affect credit ratings or mortgage applications.

A Brief History

Founded in 2001 as Moneybookers, the company rebranded to Skrill in 2011. It was one of the first e-money issuers to be authorised by the UK's Financial Conduct Authority (FCA). Today, it serves millions of customers in over 120 countries and supports 40 currencies, cementing its status as a giant in the fintech space.

How Skrill Works for Betting Users

From a functional standpoint, Skrill is straightforward. The typical betting flow looks like this:

- Create and verify a Skrill account (takes ~5 minutes).

- Fund the wallet via bank card, bank transfer, or Paysafecard.

- Select Skrill as the payment method at a bookmaker or poker room.

- Deposit instantly (funds appear in your betting account immediately).

- Withdraw winnings back to Skrill (often processed within hours).

For low-frequency or recreational betting, this process remains smooth and reliable. However, Skrill’s internal monitoring of betting behavior has become far more aggressive in recent years, which directly affects its suitability for certain strategies.

Detailed Breakdown of Skrill Fees

Understanding Skrill’s fee structure is critical for maintaining a profitable betting strategy. While creating an account is free, costs can accumulate quickly if you aren't careful. Here is a granular look at the fees you can expect in 2025.

Deposit Fees

Skrill charges a fee for uploading funds to your wallet. The exact percentage depends on your location and payment method, but typical global rates include:

- Bank Transfer: Often free or low cost (0% - 1%), but can take 2-5 business days to arrive.

- Credit/Debit Card (Visa/Mastercard): Typically 1.00% to 2.50%. Note that some card issuers may treat this as a "cash advance," charging their own additional fee on top of Skrill's.

- Paysafecard: Up to 5.00%. This is convenient for cash users but highly inefficient due to the cost.

- Crypto Deposit: Approximately 1.00% to 2.00% depending on the asset (Bitcoin, ETH, USDT).

Withdrawal Fees

Moving money out of Skrill to your personal bank or card incurs a fee:

- Withdrawal to Bank Account: Flat fee (approx. €5.50 / $5.50). This makes small withdrawals inefficient; it's better to withdraw larger lump sums.

- Withdrawal to Visa/Mastercard: Percentage fee (up to 7.50% in some regions, though often lower for VIPs).

- Crypto Withdrawal: Approx. 2.00%.

- Skrill to Skrill (P2P): 1.45% or 2.99% for non-VIPs (Free for Silver VIP and above).

Currency Conversion (FX) Fees

This is the "hidden killer" for many bettors. If your Skrill account is in EUR but you deposit into a USD poker site, Skrill charges a currency conversion fee of 3.99% added to the wholesale exchange rate. This markup is significant.

Pro Tip: Always set your Skrill wallet currency to match the currency of the sites you play on most frequently (usually USD or EUR) to avoid this fee. If you play on sites with different currencies, aiming for Silver VIP status is mandatory as it unlocks multi-currency accounts.

Administrative Fees

- Inactivity Fee: If you don't log in or make a transaction for 6 months, a monthly service fee (approx. €5.00) is deducted from your balance. Simply logging in once every few months resets this timer.

Skrill VIP Program: Tiers and Benefits

The Skrill VIP program is designed to reward high-volume users. Achieving VIP status is the most effective way to lower your costs, as it removes P2P transfer fees and lowers FX rates. The program operates on a quarterly basis, meaning you must meet the transaction volume requirements every quarter to maintain your status.

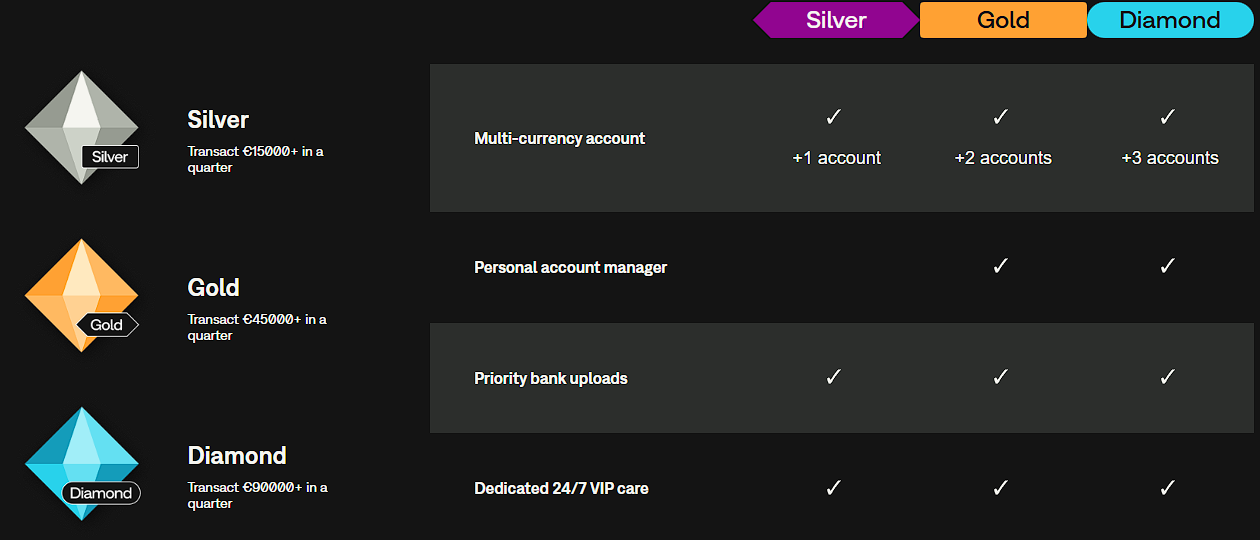

VIP Tiers & Requirements

- Skriller (Standard): Entry level. High fees, standard support.

- Silver VIP: Requires €15,000 transaction volume per quarter.

- Benefit: Free P2P transfers (send money to friends for free).

- Benefit: Multi-currency account (hold balances in EUR, USD, GBP, etc. simultaneously).

- Benefit: Reduced FX fee (down to 2.89%).

- Gold VIP: Requires €45,000 transaction volume per quarter.

- Benefit: All Silver benefits.

- Benefit: Dedicated personal account manager.

- Benefit: Higher withdrawal limits.

- Benefit: Lower FX fee (2.59%).

- Diamond VIP: Requires €90,000 transaction volume per quarter.

- Benefit: Lowest FX fee (1.99%).

- Benefit: Priority bank uploads.

- Benefit: Highest security limits.

For poker players and sports bettors, reaching Silver VIP is the "sweet spot." It unlocks the multi-currency feature, which alone can save hundreds of dollars a year in conversion fees, and it makes P2P transfers free, which is essential for trading funds with other players.

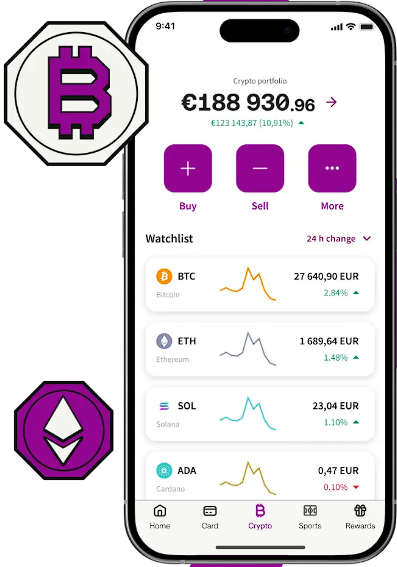

Skrill Mobile App Review

In 2025, mobile accessibility is non-negotiable. The Skrill app (available on iOS and Android) is highly rated and serves as a full replacement for the desktop site. We tested the app extensively to see how it holds up for a bettor on the go.

Key Features

- Biometric Login: FaceID and Fingerprint support make logging in instant and secure. This is crucial when you need to make a quick deposit before a match starts or top up your poker stack.

- Real-Time Notifications: Get instant push alerts for incoming funds (winnings) or successful deposits. You no longer need to refresh your email to see if a withdrawal has landed.

- Knect Loyalty Program: You can track your "Knect" points and exchange them for cash rewards directly in the app.

- Crypto Trading: Buy and sell crypto directly within the app interface. While the fees are higher than dedicated exchanges like Binance, the convenience of converting winnings into Bitcoin instantly is a major plus.

The app is generally bug-free and responsive. The only downside is that some advanced account management features (like detailed CSV statement exports for tax purposes) are easier to access via the desktop browser.

Skrill vs. The Competition

How does Skrill stack up against other major payment methods used in gambling? Here is a direct comparison.

Skrill vs. Neteller

Both are owned by the Paysafe Group and share very similar infrastructure. However, Skrill is generally slightly cheaper for non-VIPs, while Neteller has a historically stronger presence in the high-stakes poker community. Neteller's VIP program is slightly harder to climb but offers very similar perks. For most users, they are interchangeable, but Skrill’s lower base fees give it a slight edge for beginners.

Skrill vs. PayPal

PayPal is a household name but is extremely restrictive regarding gambling transactions. It is only available for betting in a few regulated countries (like the UK) and will block transactions to international or grey-market sites. Skrill, by contrast, is accepted by almost every gambling operator globally, making it the superior choice for international play.

Skrill vs. Crypto (Bitcoin/USDT)

Crypto offers lower fees and higher anonymity but comes with volatility and technical complexity. Skrill is faster (instant fiat deposits) and easier to use for those not comfortable with wallet addresses and blockchains. However, crypto is the only true option for users seeking to avoid the kind of "source of funds" checks that Skrill occasionally requires.

Verification (KYC) & Account Limits

Skrill is a regulated financial institution, which means you cannot use it anonymously. All users must pass "Know Your Customer" (KYC) checks to unlock the full features of the wallet. Without verification, your account will have strict deposit and withdrawal limits (often capped at around €2,000 lifetime).

The Verification Process

To lift these limits and unlock VIP potential, you must provide:

- Proof of Identity: A clear photo of your Passport, Driver’s License, or National ID card.

- Proof of Address: A utility bill (gas, water, electric) or bank statement dated within the last 3 months. Mobile phone bills are often rejected.

- Selfie Verification: A live webcam or mobile photo to prove you are the person on the ID.

Common Verification Delays

To avoid delays, ensure your documents are high-resolution and all four corners of the page are visible. Screenshots are usually rejected; you need a photo or a PDF of the original document. Once verified, your limits increase significantly, allowing for five-figure transactions and smooth withdrawals.

Why Skrill Is NOT Recommended for Arbitrage Betting

This point must be stated clearly: Skrill is no longer suitable for arbitrage betting.

Changes in Skrill’s internal risk profiling mean that high transaction frequency is flagged quickly, repetitive betting patterns trigger reviews, and rapid fund circulation between bookmakers raises alerts.

Arbitrage betting typically involves:

- High turnover (moving entire bankrolls daily)

- Frequent deposits and withdrawals to balance books

- Short holding periods for funds

- Multiple bookmakers connected to one wallet

This behavior profile is now explicitly incompatible with Skrill’s compliance model. Users attempting to arbitrage with Skrill often face account reviews, withdrawal delays, requests for detailed betting history, and temporary or permanent restrictions.

What Happens If You Try to Arb With Skrill

In practice, users report:

- Increased KYC requests after short periods

- Locked withdrawals pending "Source of Wealth" review

- Reduced transaction limits

- Eventual account closure

Even if funds are ultimately released, the friction makes Skrill unsuitable for systematic betting strategies where liquidity speed is everything.

Skrill and Bookmaker Profiling

Many bookmakers now treat Skrill users as:

- Experienced bettors

- Higher-risk customers

- Potentially sharp players

This results in:

- Faster stake limits (being "limited" or "gubbed")

- Reduced promotional eligibility (no welcome bonuses)

- Shorter account lifespan

For arbitrage bettors, this creates a double disadvantage: Skrill compliance scrutiny and bookmaker profiling at the same time.

Legitimate Use Cases for Skrill in 2025

Despite these limitations, Skrill still has valid use cases.

Skrill Is Suitable For:

- Casual sports bettors

- Casino players

- Poker players (especially for managing bankrolls across sites)

- Low-frequency betting

- Users prioritizing fast withdrawals

Skrill Is NOT Suitable For:

- Arbitrage betting

- Surebetting

- High-frequency betting

- Betting software–driven execution

- Multi-bookmaker fund cycling

This distinction is essential for setting correct expectations.

FAQ

Is Skrill good for betting?

Yes, for casual and recreational betting. No, for arbitrage or systematic betting.

Can you use Skrill for arbitrage betting?

It is strongly not recommended. Skrill’s compliance policies make it unsuitable for arbitrage.

Are Skrill withdrawals fast?

Yes, usually faster than bank transfers, subject to bookmaker approval.

Does Skrill charge fees?

Yes. Fees are one of Skrill’s main drawbacks.

Is Skrill safe?

Yes. Skrill is regulated and secure, but strict compliance applies.

Final Verdict: Is Skrill Worth Using in 2025?

Skrill remains a legitimate and reliable e-wallet for online betting—but its role has narrowed.

In 2025, Skrill is best viewed as:

- A convenience tool for recreational users

- A fast withdrawal method for casual betting

- A poor choice for arbitrage and professional strategies

If your betting activity is occasional and low-frequency, Skrill can still be useful. If your strategy involves structured, high-turnover betting, Skrill is no longer an appropriate option.

Sign Up Instructions

- Open a private/incognito window to avoid old cookies.

- Click the Sign Up at Skrill button below so tracking is applied.

- Create your account with accurate details; do not enter other promo codes.

- Verify your email and complete any confirmations.

- If requested, complete KYC with a valid government ID and selfie.